Key Points

- 40% Demand Surge: APS projects Arizona’s power demand will rise 40% in the next six years, driven by data centers, electric vehicles, and widespread electrification.

- Data Centers Impact: APS has received over 10,000 MW in new data center requests—more than double Palo Verde Nuclear Station’s 4,000 MW capacity.

- Pinal County Growth: SRP forecasts 12% annual growth locally, making Pinal County the top region for new meter installations outside metro Phoenix.

- Immediate Solutions: Utilities stress solar with battery storage and natural gas as the fastest options; micro-nuclear is at least a decade away.

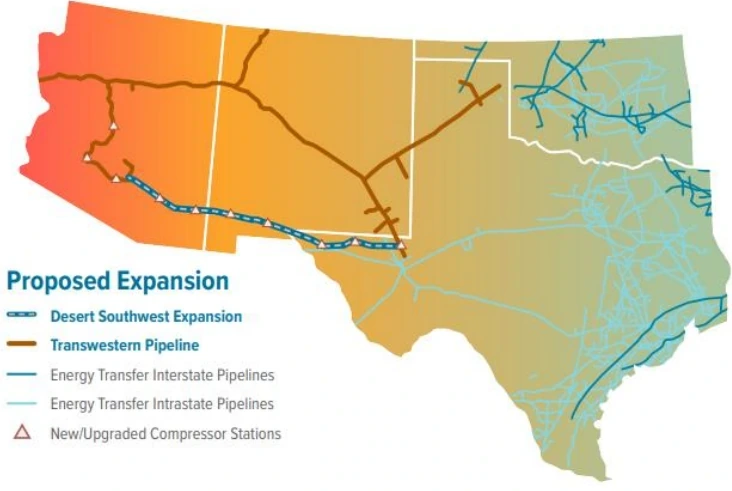

- Pipeline Expansion: The Desert Southwest Pipeline will add 516 miles and nine compressor stations, increasing design capacity to 1.5 billion cubic feet per day by late 2029 or early 2030.

- Supervisor Debate: Officials weighed public resistance to solar, the potential of micro-nuclear reactors, and the need for expedited permitting.

Board of Supervisors learns county faces dramatic power challenges as demand projected to surge 40% over next six years

The Pinal County Board of Supervisors received a stark warning about the county’s energy future during a September 10th presentation from Arizona Public Service (APS) and Salt River Project (SRP) representatives, who outlined an unprecedented surge in electricity demand that threatens to outpace current generation capacity.

Supervisors Call for Public Awareness of Energy Crisis

Chairman Stephen Miller organized the informational session to ensure residents understand the severity of the situation. “The reason I wanted to have this study session is I need the public to understand that we’re at a critical mass point on the need for more generated power,” Miller stated during the meeting.

Miller stressed that renewable energy projects, particularly solar, must move forward quickly. “And the quickest is gonna be solar, like it or not, and the second will be gas. The nuclear is probably a decade and a half away. I hope this gets put in the public, into the paper and the discussion for all of us, that the challenge is to get us to the level of demand that we’re gonna need in the future.”

Data Centers Drive Unprecedented Demand Growth

Daniel Ortega, APS Director for the Southwest and Pinal County resident, painted a sobering picture of current demand. “Recently, we had our peak demand of 8,631 megawatts of power. On that same day, Pinal County had about 305 megawatts of power. I’d just like to point out, that’s similar in size to what many data centers are, 300 megawatts. And that’s what the entirety of Pinal County used on our peak day.”

The scale of new data center demands staggers utility planners. According to APS presentations, the company has received over 10,000 megawatts of new data center customer requests, compared to the Palo Verde Nuclear Generation Station’s total capacity of approximately 4,000 megawatts – the largest single power plant in the United States. APS owns a 29.1% stake in Palo Verde, representing about 1,150 MW of the plant’s capacity.

According to APS presentation materials, the scale difference is dramatic: a typical large grocery store requires 1MW of energy – less than 1% of a typical single data center’s power. One data center needs as much power as 64,000 homes.

Multiple Causes Compound Energy Crisis

SRP forecasts annual energy growth of 6% system-wide over the next decade, compared to less than 2% from 2015 to 2025. Bill McClellan, SRP’s Director of Resource Planning Acquisition and Development, attributed this surge to several factors: “Populations are booming. Homes, businesses, and entire industries are moving towards electrification. Summers are getting hotter, and they’re lasting longer. And on top of that, our infrastructure is aging.”

APS projects even steeper growth, with Ortega stating the company expects demand to increase 40% in the next six years. “It took nearly 140 years to reach today’s demand levels. We expect this to increase by 40% in the next six years,” he explained, citing electrification, electric vehicles, and data centers as primary drivers.

In Pinal County specifically, SRP currently serves more than 90,000 customers and anticipates 12% annual growth over the next decade. APS reports that Pinal County has become the top region outside metro Phoenix for new meter installations, reflecting the area’s rapid residential and commercial development.

Short-Term Solutions Focus on Solar and Natural Gas

Both utilities emphasized that immediate solutions center on solar energy with battery storage and natural gas generation, as nuclear power remains at least a decade away.

According to Ortega’s presentation materials: “Solar with energy storage – available today. Flexible natural gas – available today. Advanced nuclear and long-duration storage – available 2035+.”

Miller acknowledged the reality of state renewable energy requirements, explaining that “the quickest renewable is solar” since wind energy isn’t viable in the region.

For natural gas expansion, both utilities pointed to pipeline constraints. Miller explained that existing gas pipeline capacity is already committed under long-term contracts, noting that “basically all the pipelines have the call on the quantity of gas that’s in them already called for” – meaning the capacity is already contractually reserved. “It’s pretty well contracted out for now and the future, so that’s the reason for another pipeline to come in.”

The Desert Southwest Pipeline Expansion Project will add 516 miles of 42-inch pipeline across Arizona, New Mexico, and Texas, with a design capacity of 1.5 billion cubic feet per day. The pipeline should enter service in fourth quarter 2029 or early 2030.

Pinal County’s Strategic Energy Position

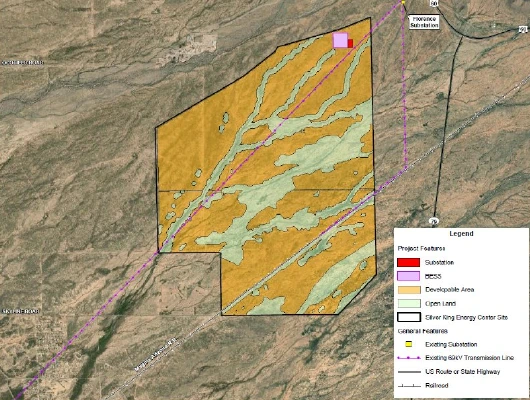

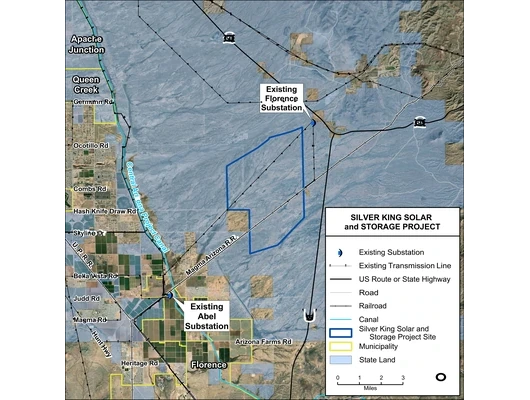

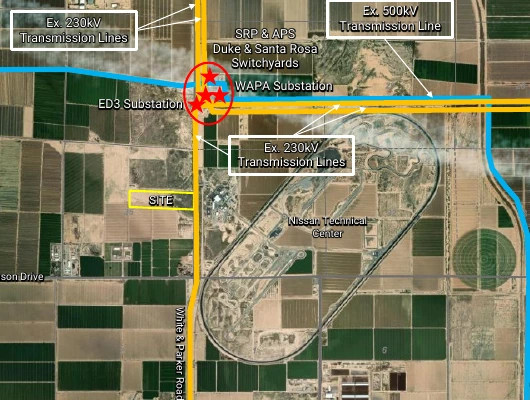

Both utilities highlighted Pinal County’s advantages for energy development. McClellan cited “available land, strong infrastructure including transmission lines, natural gas pipelines, and it’s close to areas of growth, so it’s well-positioned for energy development.”

APS plans significant infrastructure investments in the county, including a new 230KV power line from the Milligan substation to Pinal Central substation, three new substations (Bianco, Arizola, and TS 27), a new facility for the Coolidge area, and capacity expansions at existing facilities including Eastgate, Toltec, and Merrill Ranch substations. The company is also expanding transmission infrastructure on the west side with new high-voltage lines in the Bianco area near the Kohler facility.

Last year, SRP contributed $35.9 million in taxes to Pinal County, with additional community investments exceeding $260,000. APS maintains significant economic impact as Arizona’s largest taxpayer, contributing $11.3 billion annually to the state economy. The Palo Verde Nuclear Generation Station, where APS owns a 29.1% stake and SRP holds 20.2%, generates a $2 billion annual economic impact and ranks as Arizona’s largest single taxpayer.

Nuclear Power Discussion Highlights Timeline Challenges

The discussion revealed different perspectives about nuclear power’s timeline and public acceptance. Supervisor Jeff Serdy pushed for micro nuclear technology: “People are learning to hate solar, we’re just fed up with solar. The citizens don’t want it. If you talk to our constituents, they’re not against micro nuclear once you explain that it’s not the same format as Palo Verde or Chernobyl or Three Mile Island. This is a completely different thing, and it can be made to run a submarine or an aircraft carrier or a factory. Why are we not looking into that?”

SRP’s McClellan responded that nuclear development faces cost and timeline challenges: “They can be quite expensive to develop nuclear, and the timeline to be able to develop nuclear can be very long. We see that as more of an early 2040s technology.” APS suggested exploring small nuclear reactors in 10-15 years, while SRP projected deployment more likely in the early 2040s.

Chairman Miller expressed skepticism about public acceptance of any energy projects: “You think these people don’t like solar pump farms? Wait till you tell them you’re gonna put a nuclear plant in their backyard. I think that the public will be just outraged, the same as they are with the solar.”

Serdy countered: “They’re not a nuclear plant in a backyard, that’s where we have to learn what they are. They’re self-contained units and they’re actually mobile, so people don’t have a problem with it.”

Advanced Storage Technologies Offer Hope

Beyond traditional battery storage, SRP revealed plans for a pump storage project near Apache Lake, scheduled for operation in the early 2030s. McClellan explained: “Today, when we talk about storage, typically that’s the lithium-ion battery technology. Usually it’s four hours in duration. This pump storage project would be 10 hours in duration, which helps us be able to provide more reliability to our system. It really acts like a large mechanical battery by pumping the water up to the top and then releasing it back to the bottom.”

Regarding the separate Bartlett Dam project, Chairman Miller noted that costs continue escalating and Bureau of Reclamation ownership decisions remain pending, though the project continues moving forward.

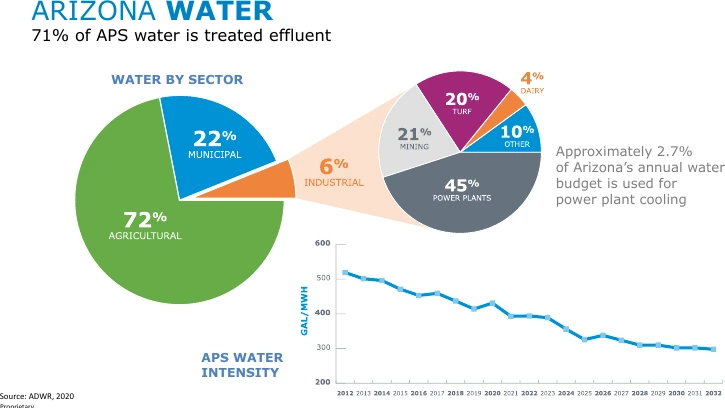

Water Efficiency Improvements Continue

Despite massive power demands, utilities report improved water efficiency. Ortega noted that APS has reduced water consumption from 500 gallons per megawatt of power in 2012 to 326 gallons per megawatt in 2025. The company uses 71% treated effluent for cooling, and the Palo Verde plant recycles more than 20 billion gallons of wastewater annually.

Residential Solar Discussion Highlights Economic Challenges

The supervisors questioned utilities about residential versus utility-scale solar economics. McClellan acknowledged that while SRP encourages rooftop solar, “it is a less economical way to get energy. Typically, on a roof, they’re what we call a fixed position, so they’re not able to produce as much energy over the course of the day. If you utilize large scale utility solar, those are on a tracking system, so they’re actually able to move along with the sun during the day.”

State Land Presents Funding Solution for Schools

Supervisor Goodman proposed using state land for energy development to fund education: “I see all this state land that isn’t specifically in our county, and most of that is leased out at $5 a head, and they can only get so many cattle on that piece of property. One of the mandates of our state land department is to maximize to the most that they possibly can, because those dollars actually go towards the beneficiaries, which is our schools and our school systems.”

Goodman argued that energy projects on state land could generate substantially more revenue than cattle grazing while funding educational needs: “If these things were looked at and landscaped properly and everything else, I think that they have a value of meeting our energy needs, providing the dollars necessary to help our education system and program go, and allow the state land department to do what they were mandated to do.”

Supervisor Perspectives on Energy Solutions

Vice-Chairman Jeff McClure viewed solar as a temporary bridge: “I look at solar as the Band-Aid for the present till you can get to the 10 years from now for nuclear. And looking at gas turbines, talking to some of the people that are wanting to put projects in, there’s a three, four-year supply line issue there.”

The supervisors generally acknowledged that solar projects with battery storage represent the fastest available solution to meet growing demand, despite public resistance to large-scale installations.

Ortega emphasized the need for expedited permitting processes, noting that transmission line approvals can take five to seven years through federal, state, and county processes.

The utilities plan to provide supervisors with detailed information about current solar commitments and future battery storage plans to help inform public discussions about Pinal County’s energy future.

Need to build a coal plant and or nuclear

You’re talking about I ut building Cogens? Ive been building them in Jersey since 1993 first one was Lakewood N.J. as a Boilermaker from local 28.

What exactly do all these data Centers do for the community Other than raise our electric and water bills ?

If solar Energy is so wonderful why hasnt it been working thus far? We need gas and coal!