Key Points for Taxpayers

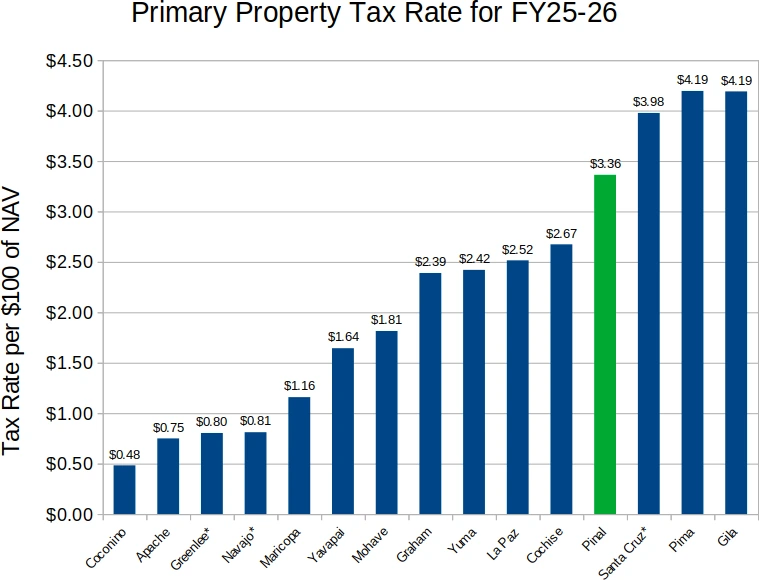

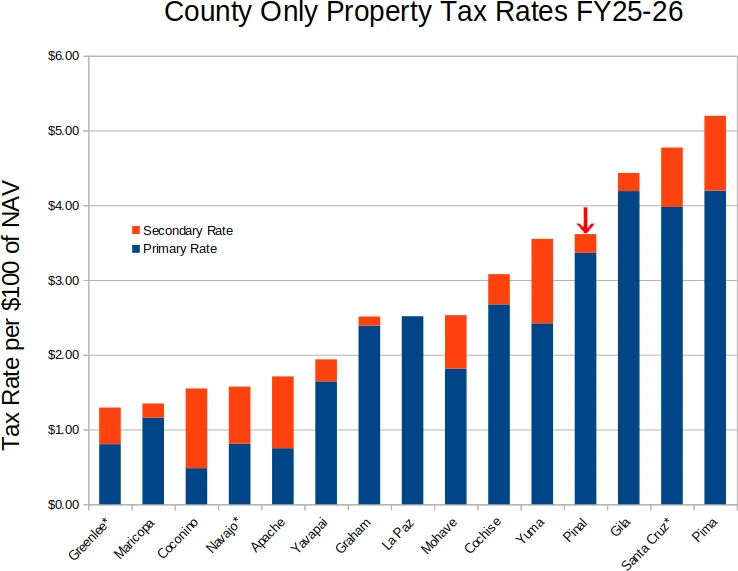

- County Rate: Pinal County’s primary property tax rate is set at $3.3630 per $100 NAV, with a secondary rate of $0.2510, for a combined county rate of $3.6140.

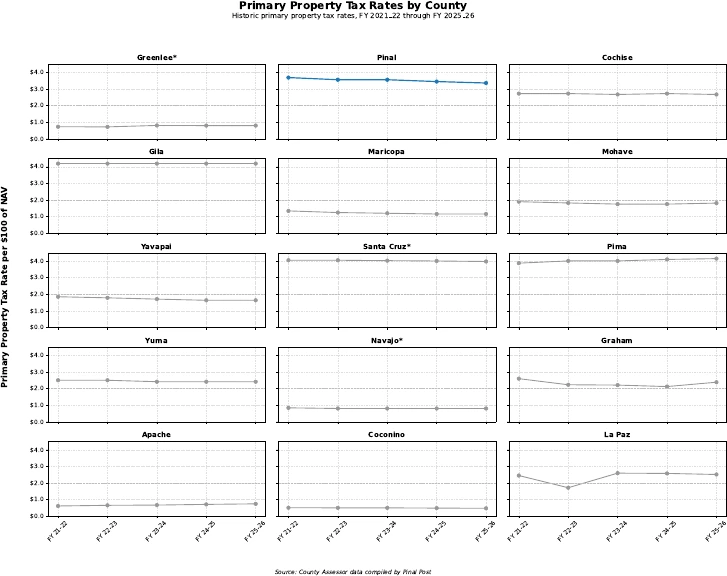

- Trend: The county cut its primary rate by 3% this year, continuing a five-year streak of reductions.

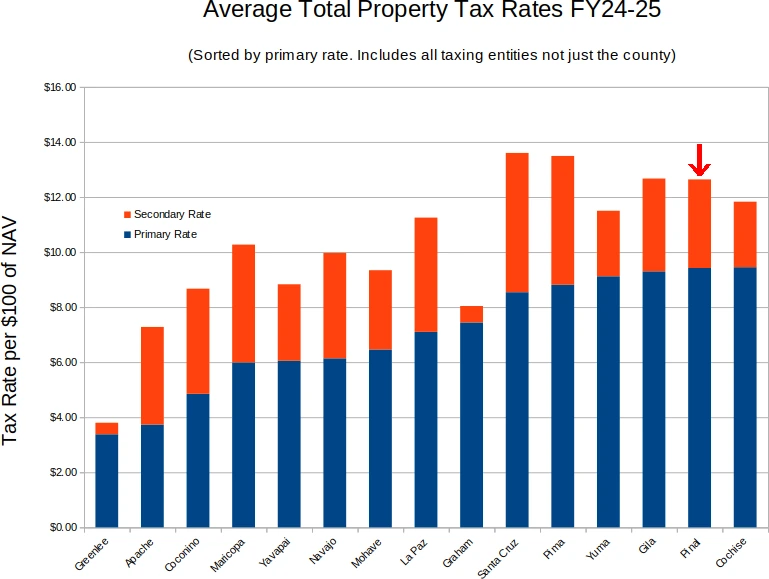

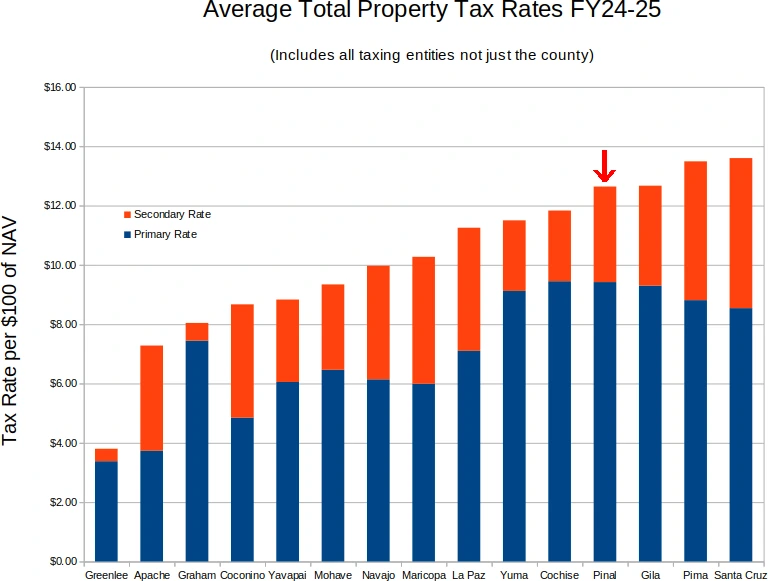

- Overall Burden: When all jurisdictions (schools, cities, districts, etc.) are included, the average property tax rate is about $9.42 per $100 NAV, one of the highest in Arizona.

- Educational Institutions: Educational institutions receive the largest share of property tax dollars — about 49% combined (35.5% for schools and 13.7% for Central Arizona College).

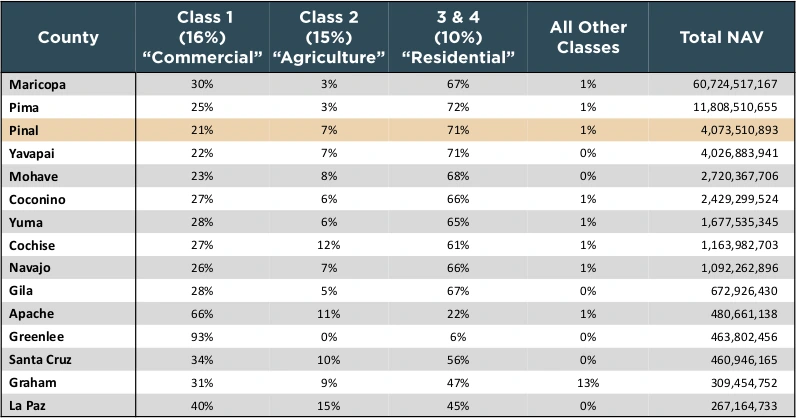

- Who Pays: With only 21% of the tax base from businesses, homeowners carry a larger share.

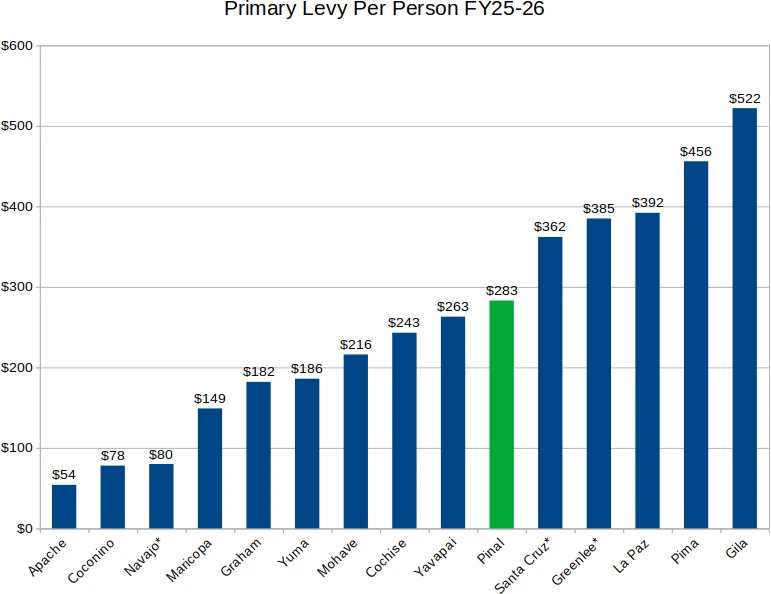

- Impact: The new levy will raise $136.9 million, equal to about $283 per resident.

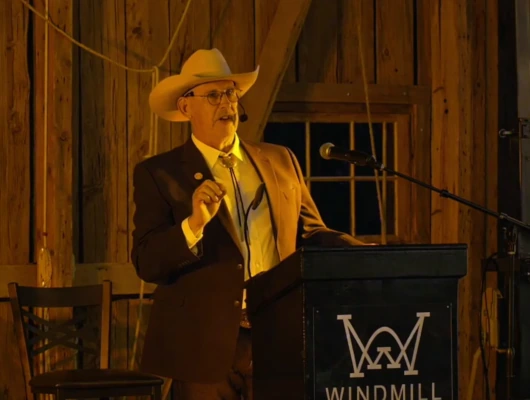

The Pinal County Board of Supervisors approved the fiscal year 2025-2026 property tax rates on Monday, August 18, 2025, with Vice-Chairman Jeff McClure presiding as chairman in Chairman Miller’s absence. All four supervisors present voted unanimously, setting the primary rate at $3.3630 per $100 of assessed valuation.

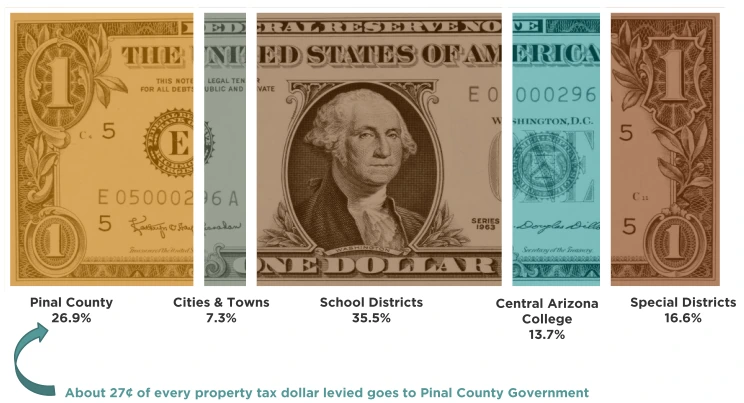

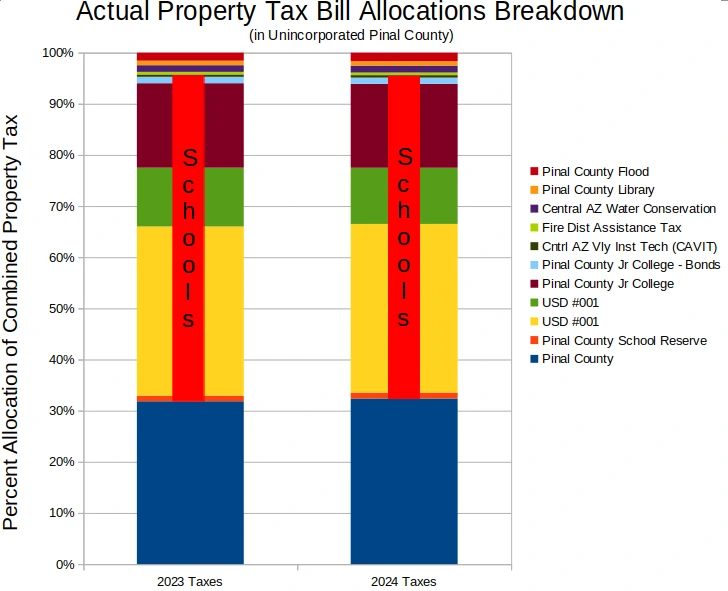

Tax Dollar Distribution

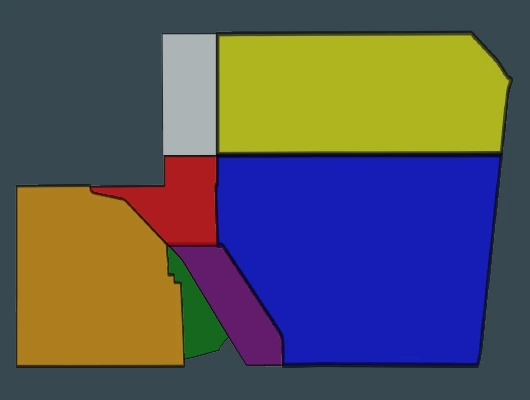

Of every property tax dollar collected in Pinal County, approximately 27 cents goes to county government, according to a presentation by Lupe Williams, Budget Supervisor with the Office of Budget and Finance. School districts receive the largest portion at 35.5%, followed by special districts at 16.6%, Central Arizona College at 13.7%, and cities and towns at 7.3%.

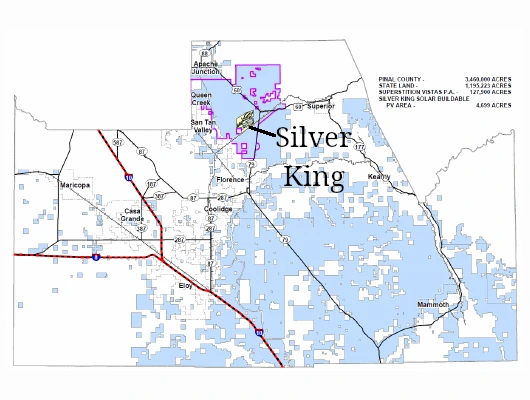

The county’s property tax base consists of 71% residential properties, 21% commercial properties, 7% agricultural properties, and 1% other classifications. Pinal County has the lowest share from commercial in the state, so with fewer businesses to tax, more of the load falls on homeowners.

County Government Reduces Tax Rates Despite High Rankings

The county government set its primary property tax rate—which funds general county operations—at $3.3630 per $100 of assessed valuation, plus a secondary rate of $0.2510 for specific purposes like flood control and library services, creating a combined county rate of $3.6140.

Among county governments statewide, Pinal ranks fourth-highest for both its primary rate and combined rate, according to the presentation data.

Despite these high rankings, the county reduced its primary rate by 3% from the previous year, continuing a five-year trend of decreases. Since fiscal year 2021-2022, Pinal County has lowered its primary rate from $3.6900 to the current $3.3630 per $100 of NAV.

The county maintains these high rankings while statewide averages continue to decrease year over year.

Property Owners Face Multiple Tax Jurisdictions

While the county government’s rates rank fourth-highest statewide, property owners actually pay property taxes to multiple local entities – school districts, cities, towns, special districts, and Central Arizona College, in addition to county government.

When examining county-wide averages that include all these taxing entities, Williams noted that in FY 24-25, Pinal County had “the fourth-highest combined rate, the primary at the second-highest, and the secondary, ninth-highest overall” among all Arizona counties. When averaging all primary tax rates from these jurisdictions within Pinal County, the result was $9.42 per $100 of NAV in FY 2024-25.

Tax Burden on Residents Has Improved Over Time

Williams explained that while Pinal County has high tax rates, residents’ ability to pay those taxes has improved significantly over time. She measured this by comparing property tax collections to total county income.

“In FY 2010-2011, Pinal County had the 2nd highest primary property tax levy burden as a percent of personal income amongst counties at 1.14%,” Williams said. Today, that burden has dropped to 0.57% of personal income, ranking sixth-highest among counties.

This improvement occurred because residents’ total income grew much faster than tax collections. Williams noted that “aggregate income has increased from FY2011 by 169%” while “the Primary Levy has increased from FY2011 by 34%.”

Property Values and Assessment Rankings

The county’s net assessed value per capita ranks fourth-lowest in the state at $8,417 per person, based on a population estimate of 483,944. This represents a slight improvement from last year when Pinal ranked third-lowest.

Williams noted that for the tax burden analysis, Pinal County “remains the 7th lowest income per capita” statewide.

Continuing the Balancing Act

The approved levy will generate $136.9 million for county operations, equivalent to $283 per resident. This per-capita levy amount ranks 10th among Arizona counties and sits $26 above the state average, according to the presentation.

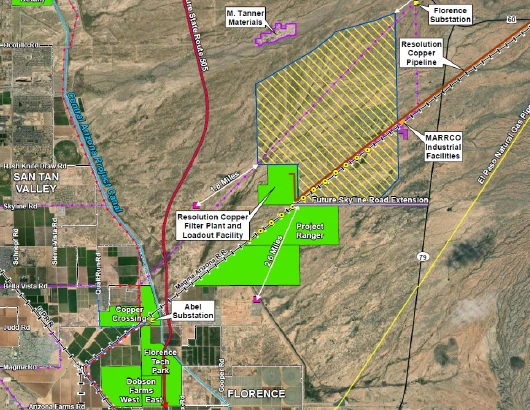

As property values and population growth continue to reshape Pinal County’s fiscal landscape, county officials will face ongoing decisions about balancing revenue needs with taxpayer burden within state statutory requirements. The board’s next budget discussions will determine whether the trend of rate reductions can continue while maintaining essential county services.

*Some data marked as tentative preliminary data in source materials