Pinal County municipalities are facing a growing fiscal crisis as the state legislature continues what Coolidge Mayor Jon Thomson described as “continuous attacks on towns and cities trying to take away our financial sources.” The latest battle centers on House Concurrent Resolution 2021 (HCR 2021), which aims to restrict municipalities’ ability to tax food for home consumption.

This proposal comes as several Pinal County cities are already declaring emergencies due to financial constraints. The Town of Florence unanimously adopted a resolution last month declaring an emergency after receiving zero applications for their Senior Civil Engineer position advertised for over six months. Meanwhile, earlier this week, the Coolidge Police Department confronted city leaders about a critical staffing crisis with the second-lowest police wages in Pinal County and an alarming officer turnover rate, losing over 25 officers in just four years.

The Real Cost to Cities and Consumers

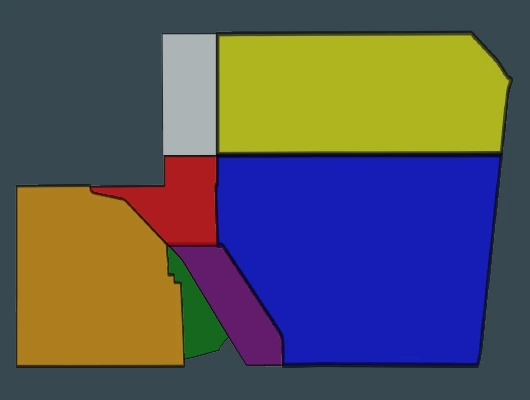

Apache Junction Management Analyst Robert Wisler presented the impact of the proposed food tax legislation to the city council earlier this week. He explained that under the originally proposed elimination of the food tax, Apache Junction would lose approximately $3.4 million annually, on top of the $1.5 million already lost when the state eliminated the residential rental tax in 2023. Even with the amended version capping the tax at 2%, Apache Junction would still lose about $672,000 per year.

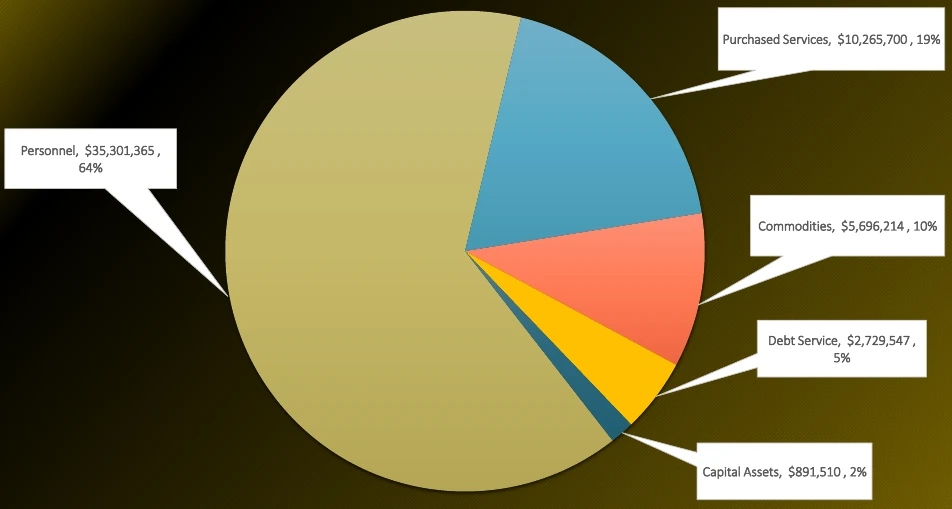

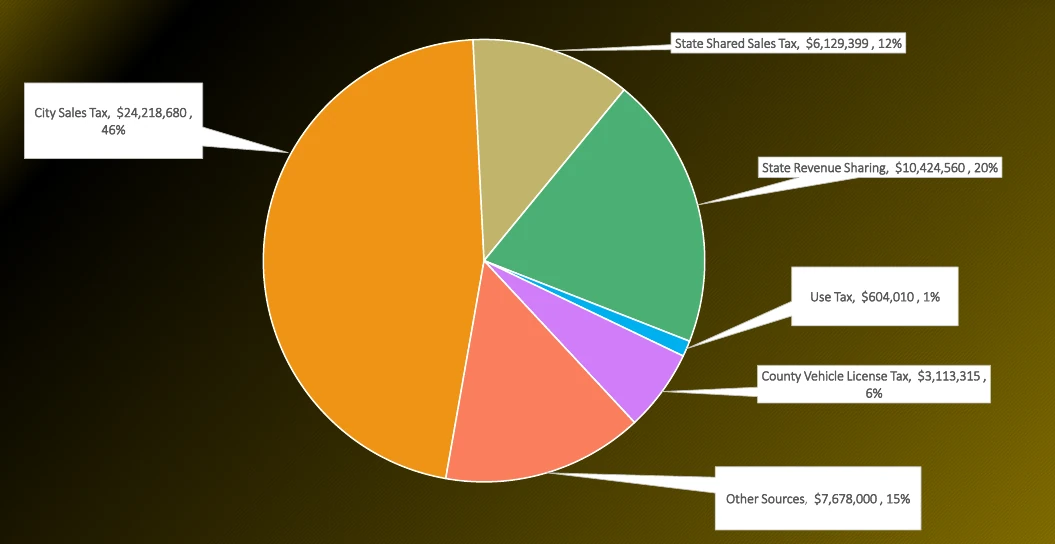

“Six hundred thousand would be a bad hit; 3.5 million would be an absolutely crippling hit to our city sales tax,” Wisler told the council, noting that “City sales tax right now is 46% of our general fund.”

[Source: Apache Junction]

City Manager Bryant Powell was even more direct about the impact: “It won’t hurt, it will crush us.” He added that the combination of losing both the rental tax and food tax would amount to “a combination of like 6 million dollars and 50% of our Personnel that you go to is our Public Safety so this is about public safety for us and all cities.”

Councilmember Bryan Soller criticized the previous elimination of the rental tax: “It wasn’t that significant of a lowering anyhow, it’s right around $21 for people for rent, and most people did not get their rent lowered. The landlords made money.”

Soller further emphasized the potential public safety implications: “The food tax is going to crush cities and I hope the people out there watching this understand 60% of our budget is personnel salaries that’s your police all your city functions if we have to make massive cuts in that it will really hurt all the residents in our city.”

HCR 2021: The Latest Threat to Municipal Revenue

Wisler provided the City Council with a detailed update on HCR 2021 during the meeting. The bill, introduced by State Representative Leo Biasiucci (R-LD 30/Lake Havasu City) on January 27, initially proposed to eliminate municipalities’ ability to impose Transaction Privilege Tax (TPT) on retail sales of food for home consumption.

As a constitutional referendum, if passed by both the State House and Senate, the measure would go before voters. If approved by a simple majority, municipalities would lose the ability to impose TPT on retail food starting June 30, 2027, with the fiscal impact beginning in FY 2028. As a House Concurrent Resolution, it cannot be vetoed by the Governor.

“As it was drafted, it’s proposed to eliminate entirely for municipalities their food tax,” Wisler explained. He clarified that despite claims from the bill’s supporters that it would only eliminate taxes on “junk items,” the bill would actually affect all food taxes equally.

Wisler also highlighted political divisions over the bill: “There’s been a lot of negotiation and infighting within the Republicans essentially two different factions – a rural faction that has in their districts many cities who this is their lifeblood… and then on the other hand you have suburban and urban Republicans who represent districts whose cities don’t even have the food tax anymore, so Phoenix, Mesa for instance they do not have food tax currently.”

Understanding Arizona’s Tax Structure

Arizona utilizes a Transaction Privilege Tax (TPT) system which, according to Wisler’s presentation, is “where the business is actually the taxpayer but of course it’s really the the consumer because the business will pass along the tax to the customers.” Municipalities can set individual TPT rates for different categories of goods and services.

The state legislature has already eliminated cities’ ability to collect taxes on residential rentals in 2023, which cost Apache Junction $1.5 million annually. Now with HCR 2021, cities face another potential revenue loss.

Vice Mayor Robert Schroeder explained that a previous attempt to eliminate the food tax was vetoed by the governor, which is why legislators are now trying to pass it as a referendum that goes directly to voters rather than requiring the governor’s signature. “They’re actually counting on the lack of knowledge regarding what’s going on realistically to these voters,” Schroeder said, adding “what voter out there would vote you know know to not get rid of taxes.”

Statewide Impact on Municipal Budgets

According to Wisler, the food tax is currently imposed by approximately 71 municipalities across Arizona, with 49 of them levying a rate higher than 2%. Under the original proposal to eliminate the tax entirely, Arizona municipalities would collectively lose about $227.6 million beginning in fiscal year 2028, according to a fiscal note on the bill.

The bill was later amended on February 19th to cap the tax rate at 2% rather than eliminate it entirely. This modified version would still cost municipalities a total of approximately $34.2 million statewide.

Consequences for Apache Junction

Wisler outlined the specific impact on Apache Junction during his presentation. Under the 2% cap, Apache Junction would lose approximately $672,000 annually. If the tax were eliminated entirely, the loss would balloon to $3.4 million per year.

To put these figures in perspective, Wisler noted that “$672,000 is more than several of our departments allocated in the general fund, and 3.5 million is effectively losing what we’ve budgeted this year for our public works department.”

City Manager Powell emphasized that these cuts would directly affect public safety services, noting that “50% of our Personnel that you go to is our Public Safety so this is about public safety for us and all cities.”

Rental Tax Impact on Seniors and Municipalities

Councilmember Peter Heck pointed out that the earlier elimination of the rental tax particularly hurt cities with significant senior populations. “Senior Living rental communities also they had to pay that rental tax so those, having been there, I know that’s a significant amount of Revenue that the city lost from that. Any Senior Living Community in this city is a rental,” Heck noted, with Wisler confirming that it “certainly had an impact on our Revenue stream, undoubtedly.”

City Manager Powell added that cities with higher proportions of rentals were disproportionately affected: “Phoenix, Mesa, Tempe, and Apache Junction proportionately it hits those,” with Wisler confirming, “proportionately we were hit significantly because we have so many rental, so many people come here to the mobile home manufactured home parks over the winter to get out of you know Minnesota, Iowa, Dakotas, so it hit us among the hardest.”

The Speeding Tickets Solution?

In a particularly exchange, Mayor Chip Wilson described a conversation with a state legislator about how cities could replace lost revenue. “One of our legislators, I went before and talked to him about this and how it would impact back to our community, and he says ‘We’ll have your police officer write more speeding tickets,’ and I said okay but now wait a minute we have to let some of the police officers go so how are we going to be able to write more tickets and we have less officers that can do the writing, and his final comment concerning was he says ‘well that’s your problem not mine.'”

Councilmember Soller expressed outrage at this suggestion: “They’re telling us to go out and hammer our public with speeding tickets. We don’t give speeding tickets to make money. No, you give tickets to change a behavior, it has nothing to do with money. The city doesn’t make money on speeding tickets, we don’t want to make that much money. What we want to do is have people comply with the law and make it safe. So this whoever you talk to is way out of line on that.”

Looking Ahead

As the legislative session continues, there appears to be some hope for municipalities. Wisler noted that the legislature has recently amended the bill such that cities with existing food taxes can maintain their current rates but would be prohibited from increasing them in the future.

“The good news, some hope in all of this, is that the legislature has amended the bill such that we will not lose any Revenue right now, as long as the bill stays in its current form through the Senate,” Wisler explained. “We won’t be able to increase in the future, but we at least would not see that hit to our budget.”

However, he cautioned that if the referendum fails at the ballot box, the legislature might interpret that as voters wanting to eliminate the food tax entirely and could return with an even more restrictive proposal.

The amended version of HCR 2021 has been transmitted to the Senate as of March 4, 2025, where it will continue through the legislative process before potentially going to voters as a referendum in the 2026 general election.