[Source: Elliot D. Pollack & Company]

The Maricopa City Council heard a comprehensive housing assessment presentation on May 20, 2025, revealing significant changes in the city’s housing landscape and identifying critical gaps in affordable housing options.

Background and Legislative Requirements

Development Services Director Rudy Lopez introduced the housing assessment by outlining the city’s proactive approach to housing planning. The city conducted its first housing assessment in 2017, which was presented to the council in 2018 and identified a critical need to diversify Maricopa’s housing stock from its overwhelmingly single-family composition.

The 2017 assessment led to the adoption of the 2019 Housing Plan by the City Council. Recent state legislation now requires all cities to conduct five-year housing assessments and plans. Maricopa positioned itself ahead of this requirement by procuring budget for the current assessment in the previous fiscal year.

Data Sources and Limitations

Danny Court, Principal Senior Economist at Elliott D. Pollack & Company, presented the updated assessment. He explained that Maricopa has grown to a population size where the U.S. Census now tracks demographic data annually.

“Throughout the report, you’ll see a mixture of one-year census data and five-year census data, just based on what information is available for City of Maricopa,” Court noted. He emphasized the need for more current data sources beyond census information, particularly for rapidly growing cities like Maricopa.

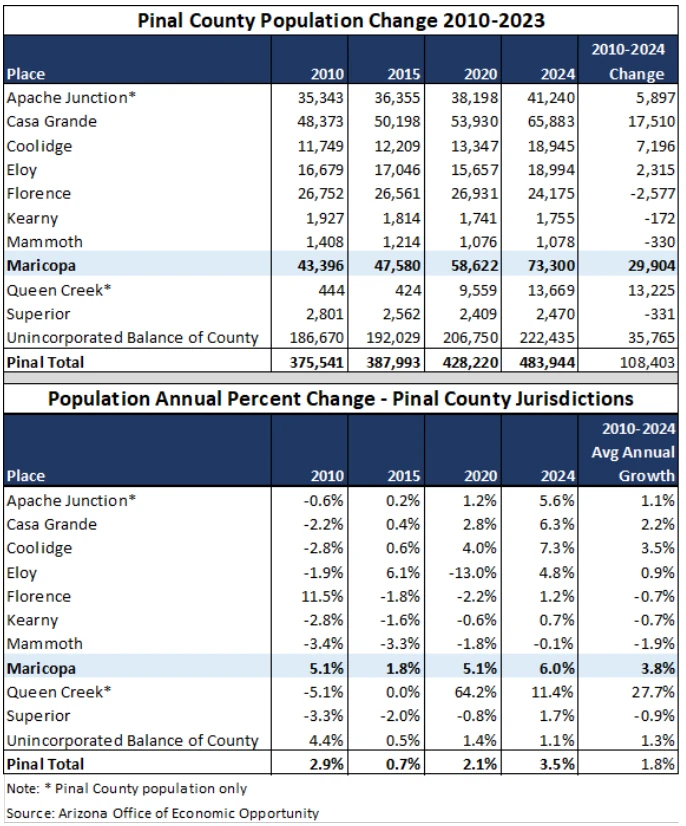

Current Population and Growth Projections

As of 2024, Maricopa’s official population estimate stands at 73,300 residents, making it the fastest-growing and largest incorporated city in Pinal County. The city also experiences seasonal population increases of 3,000 to 4,600 residents for six to nine months of the year.

The Maricopa Association of Governments (MAG) forecasts the city will reach 93,736 residents by 2029, representing a gain of 20,436 residents or approximately 6,700 new households. However, Court said MAG’s forecast is overly conservative.

Economic Development Opportunities

Maricopa has significant economic development projects on the horizon that could dramatically accelerate housing demand. According to the city’s Economic Development Department, approximately 200,000 square feet of commercial development is under construction, which will create over 400 jobs upon completion.

Two major employment projects could create nearly 25,000 new jobs locally: the SMARTRail Park with an estimated 13,000 jobs and the University of Arizona Area of Innovation with 11,300 jobs.

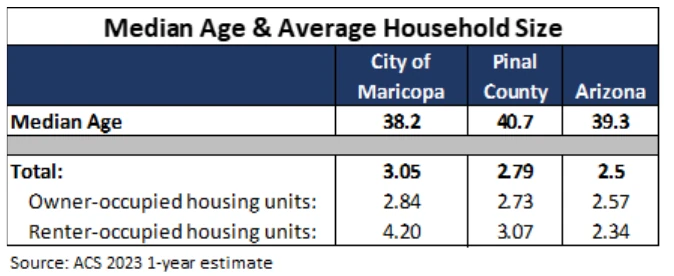

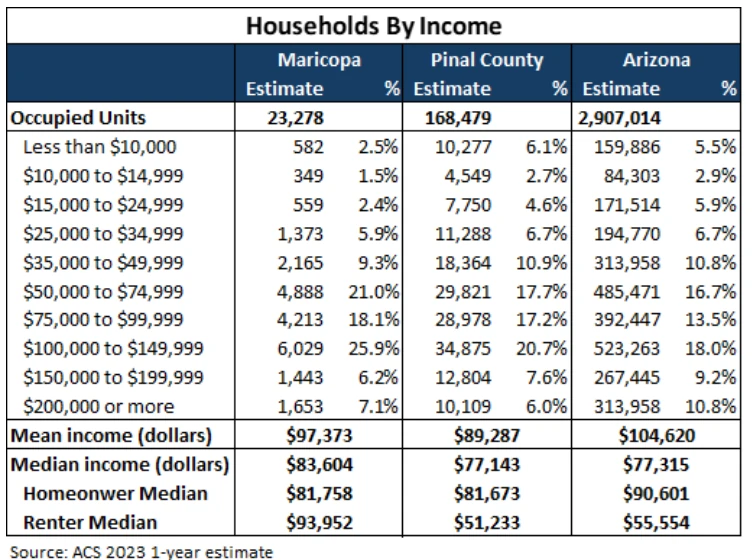

Demographics and Income Profile

Maricopa maintains a relatively young population with a median age of 38.2 years, younger than both county and state averages. The city shows a large presence of children, especially those aged 10-19. Approximately 73% of households are family households, with 36% having children under 18.

The median household income of $83,600 exceeds both county and state averages. However, income growth in Maricopa has not outpaced state growth, increasing 20.2% from 2018-2023 compared to 37.5% statewide over the same period.

Transition to Multi-Family Housing

Maricopa is experiencing a significant shift in its housing composition. Historically, the city consisted almost entirely of single-family homes, with more than 99% of housing units being single-family detached homes (97% stick-built and 2% manufactured homes).

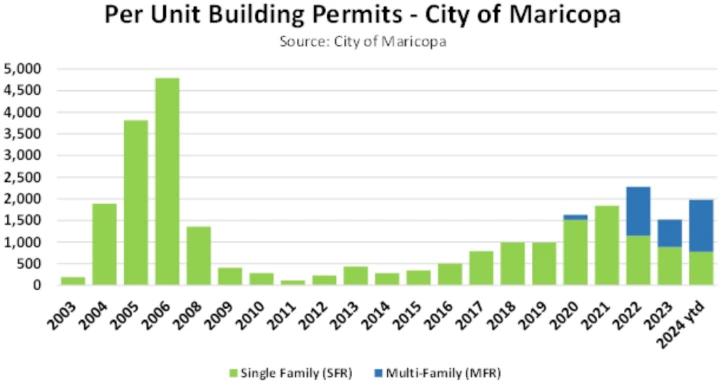

Before 2022, multifamily permitting was negligible. This changed dramatically when multi-family development meaningfully began in 2022, after decades of single-family-only development. Court explained that from 2003 to 2019, 100% of residential permits were for single-family detached units. Multi-family permitting has averaged over 50% of total residential permits from 2022 through 2024.

Court noted that 1,331 apartments have been completed, now representing approximately 5% of the city’s total housing stock. When construction currently underway is completed over the next 12 to 18 months, multi-family housing will represent 11.5% of the total housing stock.

Housing Costs and Affordability

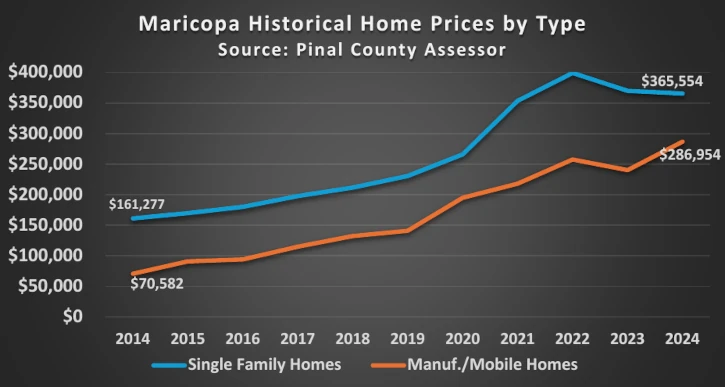

Housing costs have increased dramatically across all housing types. Single-family home prices rose 58% from 2019 through 2024, reaching an average of $365,500. Manufactured homes, while still the most affordable ownership option, have increased 103% in price since 2019 to an average of $287,000. Despite price declines from 2022 peaks, higher interest rates have made homes less affordable.

Court explained the affordability calculation: “A home at those prices required about an $82,000 household income [in 2022]. And today, at the lower prices, but the higher interest rates, it’s a $93,500 salary.”

For new homes, pricing ranges from $277,000 to $575,000, with most homes between $325,000 and $450,000. Required household incomes start at $84,000 for a $325,000 home and increase to $116,000 for a $450,000 home at current interest rates.

Affordable housing is defined as housing that costs no more than 30% of a household’s gross income. (Attainable housing, by contrast, targets households earning 80–120% of area median income.) With Maricopa’s median income of $83,600, the affordable housing value is $356,300. Notably, 53% of homes sold in the past 12 months were priced below this threshold.

Apartment Development and Vacancy

Before 2022, Maricopa had virtually no apartment complexes. The city now has 1,331 completed apartment units across seven communities, with average rents ranging from $884 to $1,898.

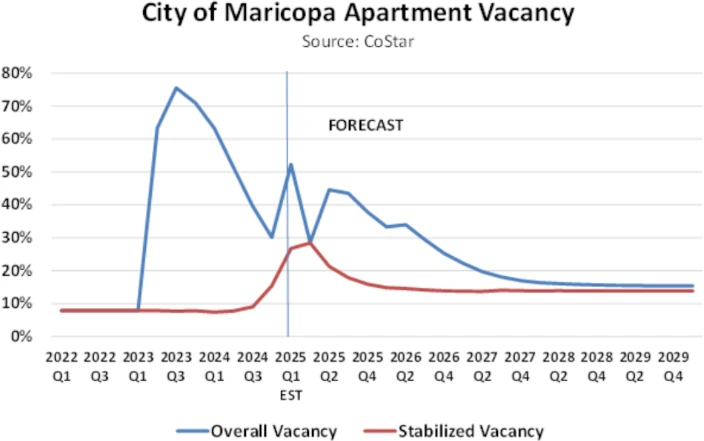

Current vacancy rates are elevated with a stabilized vacancy rate of 15.4% and an overall vacancy rate of 30%, according to CoStar, which Court attributed to substantial new supply delivered over the past year. “You actually saw, you know, basically, um, since the boom of 2006 kind of all-time highs over the last, from the last 15 years, because of that multi-family development that came online.”

The high vacancy rate has led to competitive rental markets. “A lot of communities right now offering one to two months of free rent just to attract tenants to their projects,” Court noted.

Income-Based Housing Support

The current apartment inventory serves specific income ranges:

- Studio apartments ($1,345) require $53,800 income

- One-bedroom ($1,292) require $51,700 income

- Two-bedroom ($1,616) require $64,600 income

- Three-bedroom ($1,760) require $70,400 income

Two of the seven apartment communities are designated as “affordable,” built under government programs to subsidize rent for households earning 60% or less of area median income.

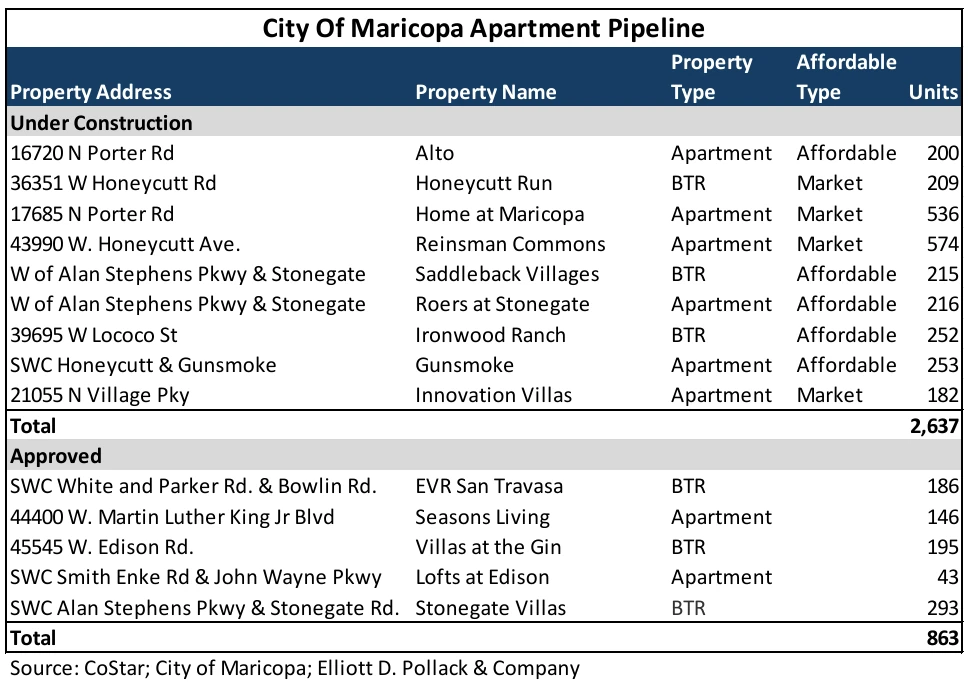

Future Apartment Construction

Maricopa has identified 2,637 apartment units currently under construction, which will nearly triple the apartment stock to 3,968 units over the next 12 to 18 months. An additional 863 units are planned and approved but haven’t started construction.

Significantly, five of the communities under construction will be rent-restricted, adding 1,136 units of affordable housing for households earning 60% or less of area median income.

At current absorption rates, Court reported that “CoStar reported 600 apartments were occupied over the last 12 months.” At this rate, he estimated it would take approximately four years to absorb existing vacancy and units under construction, extending to five and a half years including planned units, based on a current absorption rate of approximately 600 units per year.

Housing Affordability Gap

The presentation revealed a significant affordability challenge. Court defined the housing affordability gap as households paying more than 30% of their income on housing costs. In Maricopa, this affects 7,772 households, or approximately 33.4% of total households.

The breakdown includes:

- 50.8% of all renters (1,800 households) pay more than 30% of income toward housing

- 19.1% of renters (676 households) pay more than 50% of income on housing

- Nearly 6,000 owner households are cost-overburdened, meaning they pay more than 30% of their household income on housing costs including mortgage, property taxes, homeowner’s insurance and other related expenses

Court warned that “severely rent overburdened households is a leading indicator of homelessness, especially if we were to run into an economic downturn.”

The affordability gap affects different income groups requiring varied solutions:

- 401 renter households and 484 owner households earning less than $20,000 annually need public housing solutions

- 2,196 households earning $20,000-$50,000 could be served by Low Income Housing Tax Credit projects

- 3,305 households earning $50,000-$75,000 can be addressed by current market-rate apartments

- 1,386 households earning over $75,000 but still cost-burdened have various options available

For very low-income households, Court referenced innovative solutions like a Chandler program that matches roommates – “someone with a house with an extra room matching a roommate to finding a room.”

Court emphasized the growing importance of rental housing: “I just think rental units are here to stay. And it’s gonna be a growing segment of our housing stock across the region.”

Housing Recommendations

The assessment included seven recommendations to address housing gaps:

- Encourage small lot and attached ownership development, including condos and townhomes

- Continue allowing higher-density rental products in strategic areas

- Allow secondary dwelling units (accessory dwelling units) on existing lots

- Allow manufactured homes adhering to design guidelines

- Continue supporting subsidized housing programs

- Support expansion of government voucher programs

- Support housing products for senior living and aging in place

Council Member Perspectives

Council Member Amber Liermann shared a personal story highlighting the need for diverse housing options throughout residents’ lifecycles. “My parents used to live here in Maricopa, and my mom passed away in 2012. And my dad really didn’t want to live in his home anymore by himself. And he didn’t really have any options here in Maricopa, and so he lived with me for a little bit, and then he moved to Texas because there really was nowhere for him to live here.”

She also mentioned her daughter’s situation: “My daughter graduated from Maricopa High School in 2020, and there was nowhere for her to live here either. And she definitely didn’t want to live with me, and so she moved to Hawaii. And so I lost both my dad and my daughter.”

Liermann emphasized the importance of full lifecycle housing: “I think for families to have that full cycle of life housing options is really critical.”

Council Member Bob Marsh advocated for addressing both ends of the housing spectrum: “I think this is good information for covering our desire to bring in low and mid-income people to Maricopa. But I think also we should be considering the more affluent people, people who are escaping California and selling their, you know, one and a half, $2 million homes and they can bring that equity here. Also, executives at Intel, 13 miles away, pulling in $350,000 a year and more. We want to attract them to Maricopa as well.”

Next Steps for Implementation

The housing assessment will inform Maricopa’s upcoming General Plan update, which will include a housing element. Development Services Director Lopez noted that the recommendations will be considered as part of that process, though specific timing and implementation details remain to be determined.

With major economic development projects on the horizon and continued population growth expected, the city faces both opportunities and challenges in meeting diverse housing needs while maintaining affordability for essential workers and long-term residents.