Key Points

- Production Start: Targeting 2029 for first copper output.

- Project Value: Estimated at $2.3 billion with 22 years of operation producing 100,000 tons of copper cathode annually.

- Jobs & Impact: 600+ direct jobs. Economic projections include approximately $15B in activity over 31 years (per 2024 study, to be updated) and $2.3–3B+ in tax revenue over 22 years (per 2025 study).

- Major Investors: Hudbay, Royal Gold, and Rio Tinto’s Nuton hold stakes.

- Permitting: On private land with late 2026 construction decision expected.

- Public Support: 87% approval in company-commissioned community surveys.

- Education Funds: State royalties may yield $115M+ for K–12 schools in 10 years.

Arizona Sonoran Copper Company presented its Cactus Mine Casa Grande project update to the Casa Grande City Council on November 3, 2025. The presentation outlined the transformation of a former taxpayer liability into what could become the nation’s third-largest copper cathode producer. CEO George Ogilvie detailed the project’s growth, timeline, and economic impact during the study session.

From Liability to Asset

Five years ago, the former Sacaton Mine site represented a liability exceeding $100 million for Arizona taxpayers, according to Ogilvie. The site sat abandoned after ASARCO ceased operations in 1984. Arizona Sonoran Copper Company acquired the property in 2020 and has since transformed its prospects through systematic expansion.

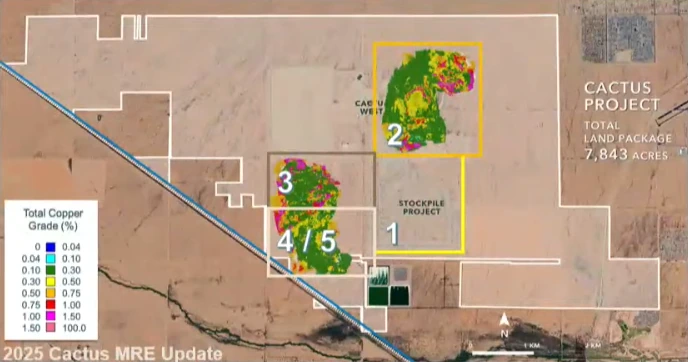

The project began in 2020 with Area 1, a historical stockpile containing 200 million pounds of copper. An initial 2020 assessment of this stockpile projected 7 years of operation and a net present value of $127 million.

By 2021, drilling around and within the existing Sacaton open pit in Area 2—now known as Cactus West and Cactus East—expanded the resource to 3.5 billion pounds and extended the potential mine life to 18 years with a net present value of $312 million.

ASARCO had drilled the Parks/Salyer area (Area 3) in the 1970s and 1980s but did not pursue it due to depth. Arizona Sonoran began drilling there in 2023 and 2024, increasing reserves to approximately 8 billion pounds. A 2024 pre-feasibility study incorporating Parks/Salyer projected 21 years of operation with a net present value of $509 million.

A transformational acquisition in March 2024 added Areas 4 and 5, the Mainspring property from a private landowner. The mineralization from Parks/Salyer extends south into Mainspring and comes toward the surface. This allows the entire Parks/Salyer deposit to be mined as a large new open pit. A 2024 preliminary economic assessment including all five areas projected 31 years of operation with an after-tax net present value of $2.0 billion.

The company released updated pre-feasibility study results in October 2025, building on the expanded resource base. Ogilvie told the council the project contains approximately 12.5 billion pounds of copper in the ground across all five areas, though the formal September 2025 mineral resource estimate reports 11 billion pounds in the measured and indicated category.

Stockpile Operations and Multiple Deposits

The Cactus Project includes three main deposits and one stockpile within a 5.5-kilometer mine trend. The original Sacaton Mine, now known as Cactus East and Cactus West, forms the core. The Parks/Salyer deposit extends southwest along the trend.

The historical stockpile represents a 500-acre pile of oxide and enriched material that ASARCO left behind in the 1970s and 1980s. At that time, ASARCO used flotation mill technology to process sulfide ores from the mine. This technology worked well for sulfides but could not economically extract copper from oxide ores. ASARCO therefore classified these oxide materials as waste and stockpiled them on site.

However, solvent extraction/electrowinning technology, which efficiently processes oxide ores, was still being refined and tested during ASARCO’s operations. The technology matured and became economically viable after ASARCO shut down the mine in 1984. Arizona Sonoran can now use modern solvent extraction/electrowinning methods to economically recover copper from material ASARCO considered waste.

The company plans to relocate this stockpile onto properly designed engineered leaching pads. This approach allows copper recovery while addressing the historical liability. The site rehabilitation represents a key environmental benefit of the project.

Significant Revenue Potential

“Now, we’ve actually grown the resource to 12 and a half billion pounds of copper in the ground,” Ogilvie told the council. “Today, the copper price on COMEX sits at five dollars US a pound of copper. There’s close to $60 billion of revenue actually sitting in the ground there, at a time when the US is gonna be demanding more copper.”

The October 2025 pre-feasibility study modeled the project using a base case copper price of $4.25 per pound. At that price, the project shows an after-tax net present value of $2.3 billion and an internal rate of return of 22.8 percent. The mine plan projects 22 years of operation producing approximately 100,000 tons of copper cathode annually.

Corporate Investor Profile

Ogilvie highlighted three major mining companies that have invested in Arizona Sonoran Copper Company.

Hudbay Mining holds a 9.9 percent ownership stake. The company, which operates the Copper World project south of Tucson, has a market capitalization exceeding $6 billion. Hudbay invested $20 million in August 2024 after conducting four months of due diligence. The company added another $6 million in July 2025 to maintain its ownership position. Hudbay holds an observer position on the company’s technical committee.

Royal Gold, with a market capitalization near $15 billion, purchased a net smelter royalty on the project. A net smelter royalty is the net revenue a mining property owner receives from metal sales after deducting transportation and refining costs. The royalty holder receives a fixed percentage of these revenues. Royal Gold purchased a 2.5 percent net smelter royalty for $55 million. Arizona Sonoran bought back 0.5 percent of that royalty for $7 million earlier in 2025.

Nuton, a Rio Tinto venture, holds a 6 percent ownership stake. Rio Tinto’s market capitalization stands at $90 billion. Nuton joined as an investor three years ago and holds an observer position on the company’s technical committee.

“The point I’m making here is that you’ve got three world-class organizations that are invested in a junior mining company,” Ogilvie explained. “If they did not expect the mine to go into production, they would not have invested monies into the company.”

Job Creation and Economic Impact

According to the 2025 Pre-Feasibility Study, the Cactus Mine Casa Grande will create over 600 direct jobs when operational. Ogilvie noted that mining positions typically pay well above $100,000 annually, significantly exceeding median wages. For every direct mining job, industry experience suggests two to three service sector positions emerge. This multiplier effect could generate an additional 1,200 to 1,800 jobs in the region, according to Ogilvie.

The company currently employs 25 people at the site. Many live in or around Casa Grande. If the project receives financing approval in late 2026, Ogilvie said employment will surge. The company expects to grow from 30 employees by year-end 2026 to over 100 within six months.

Economic impact estimates remain based on the 2024 Preliminary Economic Assessment, which studied a 31-year mine life. Ogilvie said the company plans to update these figures in the first quarter of 2026 to reflect the current 22-year plan. The 2024 assessment projected approximately $15 billion in total direct, indirect, and induced economic activity. Wages and salaries would total roughly $3.2 billion over the mine’s life with approximately 1,209 yearly jobs when combining direct, indirect, and induced employment.

According to the 2025 Pre-Feasibility Study, tax revenues will reach approximately $2.34 billion, distributed among federal, state, and municipal governments. Ogilvie noted that at current copper prices above $5 per pound, tax revenues could exceed $3 billion over the 22-year mine life.

Critical Infrastructure in Place

The Cactus Mine benefits from existing infrastructure that reduces development costs and risks. The site holds water permits extending to 2070. Wells installed during the ASARCO era remain active, equipped with functioning pumps and piezometers. These measure water volume and flow rates. A natural aquifer associated with the basement fault provides abundant water for all projected operational needs.

Power access comes through existing connections to the Palo Verde nuclear plant west of Phoenix. A 69-kilovolt power line already serves the site.

Transportation infrastructure includes direct road access to Interstate 10. The Southern Pacific Railroad formerly served the site through a rail spur. Initial plans call for trucking copper cathode to market. However, the company maintains the option to restore rail service. A reinstalled rail spur would provide efficient distribution to East and West Coast markets.

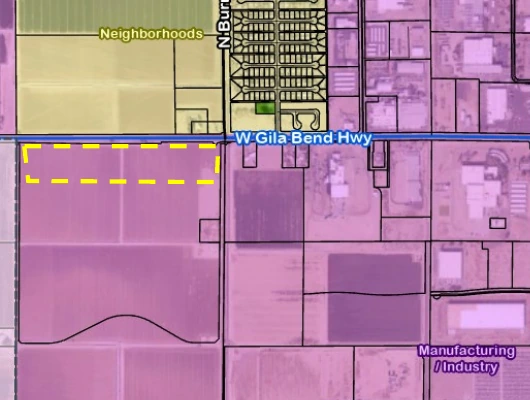

The site sits adjacent to Casa Grande’s industrial area. This location provides access to skilled labor, industrial zoning benefits, and proximity to manufacturing facilities. The private land location offers additional advantages for permitting and development.

American Copper for American Industry

The project will produce copper cathode, a pure copper product suitable for direct use in manufacturing. This distinction carries strategic significance.

“Cathode is important because it doesn’t have to leave the country and go for further smelting and refining,” Ogilvie explained. “In North America, as environmental standards have become more restrictive in the last 20 years, a lot of the smelting and refining capacity is no longer there. Unfortunately, it’s been taken up by China. More than 60 percent of the world’s copper that is actually produced is not in cathode, it’s in concentrate, and it has to go to Asia, to China to be turned into the finished product. The beauty of this copper cathode stays right within the United States, so it’s a critical metal for the US economy and manufacturing.”

Most copper mines produce concentrate, a powder containing roughly 30 percent copper. Concentrate requires additional processing at smelters and refineries before reaching final form. As environmental regulations tightened in North America, many smelters and refineries closed or relocated overseas, primarily to China.

The Cactus operation will use conventional open-pit mining combined with heap leaching and solvent extraction/electrowinning. Ore placed on engineered heaps receives sulfuric acid solution. As the acid percolates through the ore, it leaches copper into solution. This copper-bearing solution flows to tank houses where electrical current plates pure copper onto cathode sheets. The final product meets London Metal Exchange Grade A standards for direct sale to domestic manufacturers.

Streamlined Permitting Process

The project’s location on private land enables a streamlined permitting process. With no federal nexus, state agencies control the timeline. Once the Arizona Department of Environmental Quality administratively accepts permit applications, regulators have six months to respond.

The site holds major permits that are subject to amendments to incorporate the expanded project scope. The company is preparing amendments for the Industrial Air Permit, Aquifer Protection Permit, and Mined Lands Reclamation Permit.

Arizona Sonoran is preparing amended permit applications for submission in the coming weeks. The company expects administrative acceptance by late January 2026. Once administratively accepted, state regulators have six months to respond. Final permits could arrive by June or July 2026. This timeline positions the company for a construction decision in late 2026.

“We would envisage that by probably the end of January next year, those applications would be administratively accepted, which therefore means by June or July of next year, we’ll be in final possession of the permits that will allow us to construct and develop the mine,” Ogilvie said.

Community Support Remains Strong

Arizona Sonoran commissioned three community perception surveys over four years, according to Ogilvie. The most recent survey, conducted in October 2024, included 500 respondents. The same consulting firm and question set ensured consistency across surveys.

The company reported that the latest results showed 87 percent favorable support for bringing the mine back into production. This represents a 4 percentage point increase from the 2021 survey, according to the company. Support levels remain consistently high across demographics in Casa Grande and Maricopa County, the company reported.

The company maintains active community engagement. Travis Snider, VP of Sustainability and External Relations, regularly conducts site tours for residents and officials. During peak interest periods, community members volunteered to help lead tours.

Education Funding Opportunity

The Arizona State Land Department holds mineral rights to 160 acres within the project area. These state trust lands contain an estimated 1 billion pounds of copper. State law requires a minimum 2 percent royalty on mineral production from trust lands. All royalty revenues fund Arizona’s K-12 education system.

At the Pre-Feasibility Study copper price of $4.25 per pound, the state would receive approximately $115 million over the first 10 years of production. At current prices above $5 per pound, education funding would increase proportionally. The final royalty rate remains subject to negotiation with the Arizona State Land Department.

Project Financing Underway

Arizona Sonoran engaged Hanham & Partners three months ago to serve as financial advisors for project financing. The London-based firm specializes in mining project finance. Fifteen entities have entered the company’s data room under non-disclosure agreements.

Potential funding sources include export credit agencies such as the U.S. Export-Import Bank, Export Development Canada, and Germany’s KFW. Five to six commercial banks have begun preliminary reviews. Private lenders also expressed interest. Several commercial banks indicated soft interest ranging from $100 million to $250 million in potential funding.

“On a billion dollar upfront capital, we’ll probably be looking at $600 million of debt and $400 million US of equity will have to be issued,” Ogilvie explained.

The financing process follows a defined timeline. Over the next four months, potential lenders will conduct high-level due diligence. In early 2026, the company will request formal proposals. The field will narrow from 15 candidates to four or five participants forming the project syndicate.

Once the syndicate forms, an independent engineer enters the process. This engineer conducts additional due diligence over six to nine months. By the fourth quarter of 2026, the company anticipates receiving commitment letters for the debt portion. Attention then shifts to raising the equity component. With commitments secured, the company can make a final investment decision in late 2026.

Timeline to First Production

If groundbreaking occurs in early 2027, construction will take approximately 24 months. During construction, the company will simultaneously remove overburden—the waste rock and soil covering the ore deposit. This pre-stripping work allows mining to begin immediately once facilities are complete. First copper cathode production is targeted for the second half of 2029.

Council Members Express Support

Mayor Lisa Navarro Fitzgibbons opened the floor for questions following the presentation. Mayor Pro-Tem Matt Herman spoke first, echoing the mayor’s appreciation for the company’s community engagement.

Herman noted a personal connection to the project. “My personal history goes back and Anthony’s as well,” he said. “Our dads worked at the mine together.”

Herman emphasized the project’s unique position. “The neat thing about this project that you guys have taught me over the past couple years is that there’s already a hole there,” he explained. “We were gonna have to do something with it one way or the other. You guys actually found a way to make it profitable and not be a liability.”

City Manager Larry Rains highlighted ongoing discussions about a potential effluent agreement. The city deliberately excluded this topic from the evening’s presentation due to active negotiations. Rains invited council members interested in learning more about the project to schedule individual meetings with company representatives.

The Casa Grande City Council will continue discussions with Arizona Sonoran Copper Company as the project advances through permitting and financing stages. The company expects to provide updates as it reaches key milestones toward its anticipated late 2026 construction decision.