Audit Overview

The Pinal County Board of Supervisors received their fiscal year 2022-2023 Annual Comprehensive Financial Report (ACFR) and audit results during a board meeting on April 30, 2025. The Arizona Auditor General’s office, represented by Financial Audit Manager Vicky Fisher, together with auditing firm Walker and Armstrong, presented the findings to the board.

Fisher explained that the Arizona Auditor General is responsible for conducting annual audits of all Arizona counties or for causing those audits to be conducted. Due to staffing levels and other audit demands, the Auditor General sometimes contracts out audits.

“When we contract county audits, we ensure that we select qualified CPA firms with the experience in auditing counties and the understanding of how they operate within Arizona,” Fisher told the board. “We have contracted with Walker and Armstrong for the county’s audits through fiscal year 2023,” she added.

Curtis Bright, CPA and auditor with Walker and Armstrong, reported that they issued three separate documents for the June 30, 2023 audit: an annual comprehensive financial report containing the financial statements and audit opinion, a single audit report for federal funds, and a separate letter to the board.

Financial Position

Bright reported that the firm issued an “unmodified or a clean opinion on the financial statements, which means that they are materially correct as they apply to how a government should issue a financial statement,” he explained.

He noted one major change from 2022 to 2023 in the accounting rules: “There was a new implementation of a new accounting standard regarding subscriptions, to bring the liabilities on the books for any contract subscriptions that you have on record,” Bright said.

The audit revealed several positive financial indicators. Pinal County’s total governmental cash was $392 million, which increased $72 million from the prior year. This represents 92% of the total expenses for 2023, indicating a healthy cash reserve.

“The total pension liability is $162 million, and that includes all funds, all plans that the county participates in,” Bright reported. This represented an increase of $32 million from the prior year.

Capital assets (such as buildings, roads, and equipment owned by the county) increased by $256 million, primarily due to new acquisitions and construction totaling $324 million during the year, offset by depreciation (the decline in value of these assets over time) of $39 million. Non-current liabilities (long-term financial obligations the county must pay beyond the current year) increased by $102 million, largely because the county issued bonds payable (debt securities sold to investors to raise funds) of $116 million in 2023.

Revenue and Expenses

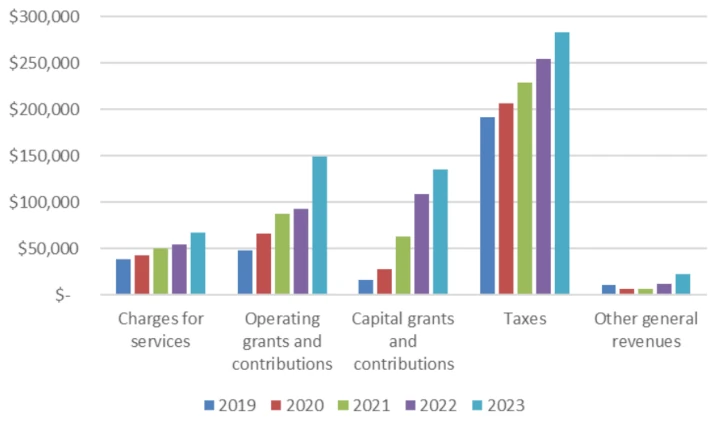

According to Bright’s presentation, Pinal County’s total revenues increased by $131 million (25%) from fiscal year 2022 to 2023, rising from $526 million to $657 million. Operating grants and contributions increased by $54 million due to federal funding for the Emergency Rental Assistance Program (ERAP) and the American Rescue Plan Act (ARPA).

Capital grants and contributions increased by $26 million due primarily to the build grant for highway road projects. Overall tax revenues increased by $28 million, including increases of $11 million in property taxes, as well as $6.5 million in county sales taxes, $5.1 million in state shared sales taxes, and $2.4 million in other miscellaneous taxes.

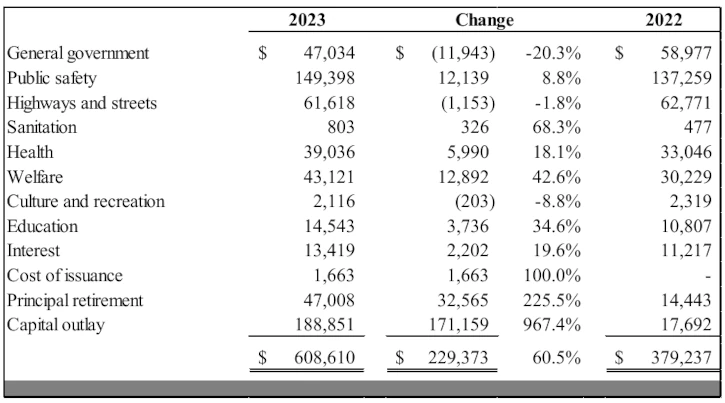

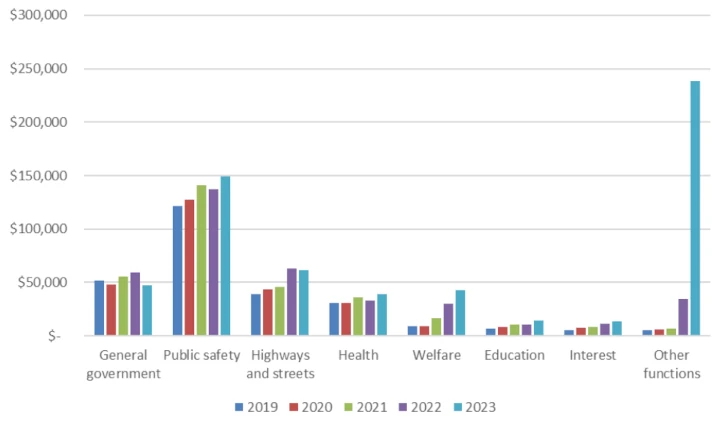

On the expenditure side, total expenses increased by $229 million (60.5%) from 2022 to 2023, rising from $379 million to $609 million. While general government expenses decreased by $12 million due to significant IT infrastructure purchases in 2022 that weren’t repeated in 2023, public safety expenses increased by $12 million, almost exclusively from salaries and related items.

Welfare expenditures increased by $13 million (42.6%), primarily due to the Emergency Rental Assistance Program and other public housing assistance. Capital outlay saw the most dramatic increase, rising by $171 million (967.4 percent) from $18 million to $189 million.

Audit Findings

Despite the unmodified opinion on the financial statements themselves, the auditors identified several issues with the county’s internal controls and federal program compliance.

Financial Statement Findings

Bright reported that in 2023, auditors identified a total of 3 material weaknesses and 6 significant deficiencies in internal control, spanning both financial reporting and federal award program compliance.

- Finding 2023-001 – Cash Reconciliation (Repeat Finding) – Significant Deficiency

- The County has a payroll bank account that has not been fully reconciled since July 2016.

- Finding 2023-002 – Receivables (Repeat Finding) – Significant Deficiency

- The County accrues court and other miscellaneous receivables at year-end based on assumption that all July and August cash received are collections for events prior to June 30.

- Finding 2023-003 – Improve the Timing and Effectiveness of Financial Reporting (Partial Repeat Finding) – Significant Deficiency

- Financial statements were due March 31, 2024, but weren’t issued until January 28, 2025. The finding also recommends providing more frequent financial information to the board, beyond just meeting reporting deadlines.

- Finding 2023-004 – Perform a Comprehensive Risk Assessment over Information Technology and Create Policies and Procedures – Significant Deficiency

- The need to perform and document risk assessments and develop corresponding policies. Bright noted they met with IT staff confidentially to discuss specific security concerns rather than detailing them in public meetings.

- Finding 2023-005 – Improve Information Technology Policies and Procedures Over Granting and Managing Access to Significant Systems and Data – Significant Deficiency

- The County’s internal control over information technology does not follow the practices set for by NIST.

- Finding 2023-006 – Improve Internal Controls over Account Reconciliation – Material Weakness

- The county failed to include the Education Services Department in the financial statements and did not accurately identify available and unavailable revenues on a fund basis, requiring adjustments

Federal Award Program Findings

The audit also identified issues with federal program compliance:

- Finding 2023-101 – Improve the Timeliness of Filing the Financial Audit (Repeat Finding) – Significant Deficiency

- The financial reports were filed 10 months late

- Finding 2023-102 – Inaccurate Amount on the Voucher Management System Submissions (Repeat Finding) – Material Weakness

- The amounts of the restricted net position reported to the U.S. Department of Housing and Urban Development were incorrect

- This finding was reported by other auditors

- Finding 2023-103 – Spending not in Compliance with Activities Allowed by the Compliance Requirements (Repeat Finding) – Material Weakness

- The restricted cash for the housing program does not exceed the ending housing assistance payment restricted net position

- This finding was also reported by other auditors

County’s Response and Timeline

When Vice Chairman Jeff McClure questioned the 10-month delay in reporting, Deputy Director of the Office of Budget and Finance Randee Stinson explained the office’s efforts to address the issues.

“Our mission statement is inspiring the gold standard of financial stewardship,” Stinson said. “During the past few years, our office has been busy hiring, educating, and creating processes that provide solutions to our audit findings.”

Stinson noted that the fiscal year 2023-2024 audit is currently underway. “We began working with the Arizona auditor’s office in December [2024] and currently have an anticipated completion date of August 2025. Meeting this goal will mean that we have completed this audit in eight months, a substantial improvement over the time it took to complete the fiscal year 2023 audit,” she explained.

Director of Office of Budget and Finance Angie Woods added that the department is now “what I would consider fully staffed” to address the findings. “We’ve done a lot to partner with those departments that we’re reliant on. We’ve done a lot of educating them, and we plan to continue those efforts. Departments today understand much more of the impacts they have on this audit,” she told the board.

Supervisor Mike Goodman asked whether county departments were doing what they needed to do to help bring reporting up to speed. Woods responded that they’ve made significant improvements in the process. “Are we all the way there yet? No. But it is a great improvement,” she stated.

Woods acknowledged that while the county might not meet the March deadline for the next audit, they’re continuing to improve processes and procedures to move toward compliance. “We’ll make every effort to do so, but we’re gonna continue to back that date up to that March deadline,” Woods stated.

Future Expectations

The Office of Budget and Finance will continue to implement monthly reconciliation processes to prevent future findings. The fiscal year 2023-2024 audit should be completed by August 2025, showing significant improvement in timeliness. County staff will continue partnering with departments to provide training and support for all aspects of budget and accounting.

While the audit revealed several areas needing improvement, particularly around reporting timeliness and internal controls, the county received an unmodified opinion on its financial statements and appears to be in a strong financial position with increasing revenues and healthy cash reserves.