News/Image Source: City of Maricopa

MARICOPA, AZ — Residents of Maricopa now have a new way to see exactly how their tax dollars are being invested into the community’s transportation future.

The City of Maricopa has launched a new online transparency dashboard that allows residents to track revenue and expenses generated by the council-approved ½-cent sales tax dedicated to transportation improvements. The dashboard will be updated monthly and reflects the City Council’s commitment to full transparency when the tax was adopted in 2025.

Residents can view the revenue and expense tracker and learn more about transportation projects funded through the ½-cent sales tax by visiting: Building Better Roads | Maricopa, AZ

As one of Arizona’s fastest-growing communities, Maricopa continues to experience increased demand on its transportation system. The ½-cent sales tax was approved to help fund the construction and expansion of major commuting corridors designed to improve traffic flow, enhance safety, and create reliable regional connections.

“From the moment Council approved this sales tax, we made a commitment to the public that every dollar would be tracked and accounted for,” says Mayor Nancy Smith. “This dashboard delivers on that promise by allowing residents to see, in real time, how their small contributions are helping build major transportation improvements.”

Supporting a Citywide Transportation Network

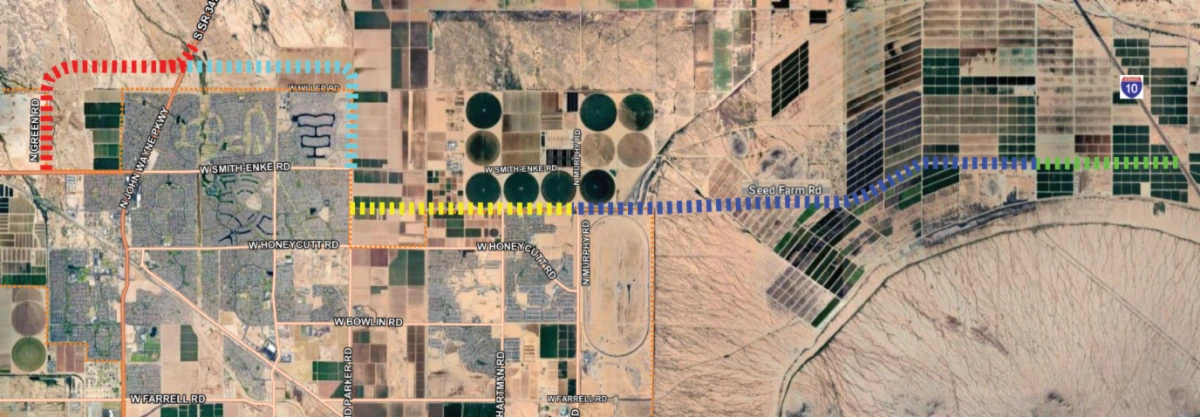

While improvements to State Route 347 are a central part of the transportation strategy, the tax funds a broader, long-term plan to improve mobility throughout Maricopa. Projects funded through the tax support a connected system of major commuting corridors that provide alternate routes, reduce congestion, and improve access to regional highways such as Interstate 10.

Key elements of the transportation plan include:

- Enhancing SR-347 capacity and reliability

- Improving SR-238 to redirect regional and truck traffic away from residential areas

- Developing a loop road system to improve local traffic flow and reduce congestion along John Wayne Parkway

- Expanding and constructing additional major arterial roadways that support Maricopa’s continued growth

The transportation improvements funded through this tax are designed to serve Maricopa both today and well into the future.

How the Sales Tax Works

The ½-cent sales tax applies to select purchases such as restaurant meals, retail goods, entertainment admissions, home improvement materials, and certain personal services. On a typical $10 purchase, the tax adds approximately five cents.

Many everyday essentials remain exempt from the tax, including groceries for home consumption, gasoline, prescription medications, rent and housing payments, and hotel lodging.

Because the tax is applied to purchases made within Maricopa, residents, visitors, and commuters who shop or dine in the community all contribute toward improving the transportation network.

Restricted Funds for Transportation Only

Revenue generated by the tax is legally restricted and can only be used for transportation-related improvements. The City estimates the tax will generate millions of dollars annually to support roadway infrastructure projects.

At the time of adoption, the tax was projected to remain in place for approximately 20 years to fund multiple transportation improvements. Future City Councils will retain authority to adjust the duration based on funding needs and project completion timelines.

Why the City Invests in SR-347

Although SR-347 is a state highway, it serves as Maricopa’s primary transportation lifeline. The City’s participation in funding improvements helps accelerate construction timelines, leverage regional and state partnerships, and ensure local transportation needs are prioritized.