Key Points

- The presentation was informational only. No action was taken.

- San Tan Valley has $8.8 million in state-shared revenue. The town cannot spend it yet.

- The town received $4.9 million in state-shared TPT last week. This is not a locally imposed tax.

- State shared revenue of $45-50 million annually will not cover the costs of running the city.

- San Tan Valley is likely the only Arizona municipality without a local TPT rate.

- Food tax is likely unavailable due to state legislation. Two bills are pending: HCR 2018 and HB 2839.

- TPT implementation takes approximately four months.

- New rates must begin on the first day of a calendar quarter, such as July 1 or October 1.

- Mayor Schnepf directed staff to research TPT options.

San Tan Valley moved one step closer to implementing a transaction privilege tax (TPT) yesterday evening. The Town Council received an educational presentation on January 21, 2026, covering how TPT works and what rates neighboring cities charge. The session was informational only. No action was taken.

Financial consultant Bill Kauppi from Pat Walker Consulting delivered the presentation. It followed a January 7 overview of budget requirements, tax rates, and spending limits by consultant Pat Walker. Kauppi explained TPT fundamentals and compared rates across Pinal County municipalities. Council members then directed staff to research TPT options and gather data on local businesses that could contribute tax revenue.

State Shared Revenue Arrives—But Other Cities Lose Their Share

At the January 7 council meeting, Walker noted that state-shared sales tax would begin arriving “soon.” That money has now come in.

Town Manager Brent Billingsley reported on the town’s financial position. “We now have around $8.8 million dollars in the bank for San Tan Valley. We can’t spend it, but we have about $8.8 million dollars in the bank,” Billingsley said. “And that’s a very large increase from our last meeting, which is received with some controversy, because we got $4.9 million dollars in transaction privilege taxes last week. The pies don’t get any bigger. It’s just another slice out of the pie. That means that every other city and town in Arizona loses TPT because we are receiving our TPT.”

Kauppi clarified that this $4.9 million is state-shared TPT revenue, not a locally imposed tax. “The money that was collected is state shared revenues,” Kauppi said. “It is not part of the presentation I’m doing tonight… You have not [implemented a tax]. So you’re just at the very, very early stages of that process.”

Financial consultant Bill Kauppi explained that state shared revenues alone cannot sustain municipal operations.

“You’re coming in with around $50 million state share revenues, give or take 45 to 50 million depending on your population,” Kauppi said. However, he cautioned that this amount will not cover the costs of running a city. Additionally, part of this money is restricted. “Part of that’s for Highway User Revenue Fund. You can’t really touch that other than for street maintenance,” Kauppi said.

“After a year or so, you’re gonna see that that money just pales in comparison to the costs associated to running a city,” Kauppi said. He emphasized that public safety services are particularly expensive.

San Tan Valley TPT Would Fund Essential Services

Transaction privilege taxes fund public services across Arizona municipalities. According to Kauppi’s presentation, these include community programs, economic development, and public safety.

Unlike a traditional sales tax charged to consumers, TPT is levied on businesses for the privilege of operating within a jurisdiction. In practice, however, businesses typically pass this cost to customers. Kauppi illustrated the impact: a 2% town rate on a $500 television would mean an additional $10 for the buyer.

Currently, Kauppi noted, residents pay 6.7% combined tax on purchases. This includes the 5.6% state rate and 1.1% Pinal County rate. San Tan Valley has not yet implemented its own municipal rate.

Only Arizona Municipality Without TPT

As a newly incorporated town, Kauppi said San Tan Valley is likely the only one of Arizona’s 92 municipalities without a TPT rate. “Pretty much every town and city in Arizona has some type of transaction privilege tax,” he noted.

The town’s situation is historically unusual. Kauppi explained that newly incorporated cities rarely begin with such large populations.

“San Tan is unique in the fact that newly incorporated cities typically don’t come with 100,000 people, give or take,” Kauppi said. “I did research and I think there’s only one other city in Florida, I believe, that was slightly over 100,000 people that incorporated.”

Mayor Daren Schnepf noted that San Tan Valley’s population exceeds many comparison cities shown in the presentation. The exact count will be confirmed when census data becomes available. This matters because state shared revenue distributions depend on population size.

TPT Rates Vary Across Pinal County Municipalities

Neighboring cities charge varying rates depending on business category. Kauppi’s presentation showed the range of TPT rates for towns and cities within Pinal County:

- Apache Junction: 2.4% to 3.4%

- Casa Grande: 1.8% to 4.0%

- Coolidge: 3.0% to 4.0%

- Eloy: 2.0% to 4.5%

- Florence: 2.0% to 4.0%

- Maricopa: 2.0% to 5.5%

The following table shows current TPT rates by category for cities and towns in Pinal County:

| Industry Group | Apache Junction | Casa Grande | Coolidge | Eloy | Florence | Kearny | Mammoth | Maricopa | Superior | Queen Creek |

|---|---|---|---|---|---|---|---|---|---|---|

| Contracting Activities | 2.40% | 4.00% | 4.00% | 4.50% | 4.00% | 4.00% | 4.00% | 3.50% | 4.00% | 4.25% |

| Hotels | 2.40% | 1.8% / 5.0% | 3.00% | 4.0% / 3.0% | 2.00% | 4.00% | 4.00% | 2.0% / 5.5% | 4.00% | 2.25% / 3.0% |

| Commercial Rental, Leasing | 2.20% | 1.80% | 3.00% | 3.00% | 2.00% | 2.50% | 4.00% | 2.00% | 2.00% | 2.25% |

| Restaurant & Bars | 2.40% | 1.80% | 3.00% | 5.00% | 2.00% | 4.00% | 4.00% | 2.00% | 4.00% | 2.25% |

| Retail | 2.40% | 2.00% | 3.00% | 3.00% | 2.00% | 4.00% | 4.00% | 2.00% | 4.00% | 2.25% |

| Retail - Food for Home Consumption | 2.40% | 2.00% | 3.00% | 2.00% | 2.00% | 4.00% | 4.00% | 2.00% | 0.00% | 2.25% |

| Communications | 2.40% | 2.00% | 3.00% | 3.00% | 2.00% | 4.00% | 4.00% | 2.00% | 4.00% | 2.25% |

| Use Tax | 2.40% | 0.00% | 3.00% | 3.00% | 2.00% | 4.00% | 2.00% | 2.00% | 0.00% | 2.25% |

| Utilities | 3.40% | 2.00% | 3.00% | 3.00% | 2.00% | 4.00% | 4.00% | 2.00% | 4.00% | 2.25% |

| Other* | 2.40% | 1.80% | 3.00% | 3.00% | 2.00% | 4.00% | 4.00% | 2.00% | 4.00% | 2.25% |

The state rate of 5.6% and Pinal County rate of 1.1% apply in addition to municipal rates.

Revenue Comparison Shows TPT’s Critical Role

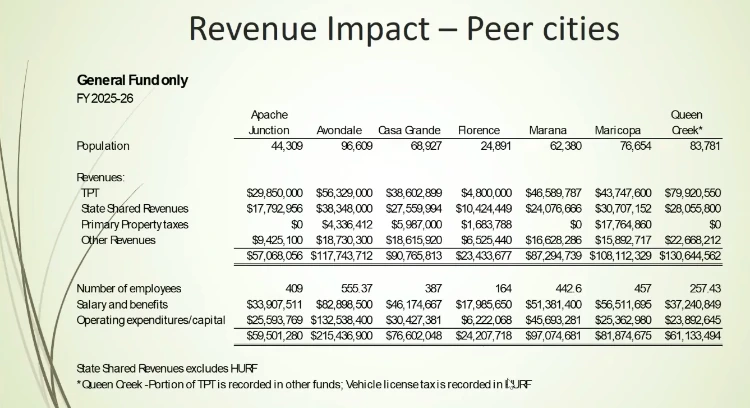

Kauppi’s presentation showed how peer cities rely heavily on TPT revenue. Apache Junction, with a population of 44,309, collects approximately $29.85 million in TPT revenue annually. Its state shared revenues total only $17.79 million. Queen Creek generates $79.92 million in TPT revenue with a population of 83,781.

Maricopa, with 76,654 residents, collects $43.75 million in TPT. That city also levies $17.76 million in primary property taxes. By contrast, Apache Junction, Marana, and Queen Creek do not collect primary property taxes.

Factors Guiding Rate Decisions

Councilmember Bryan Hunt asked what motivates municipalities to set specific rates. Kauppi explained that multiple factors influence these decisions.

Rate-setting involves analyzing the local business mix. Staff will work with the Arizona League of Cities and Towns and the Arizona Department of Revenue to estimate taxable sales within San Tan Valley’s boundaries.

“You want to build your retail base, but you want to do it in a way that’s going to encourage development,” Kauppi said.

Higher rates in certain categories can generate one-time revenue for capital projects. However, rates significantly above neighboring cities could push consumers to shop elsewhere.

Queen Creek, for example, charges 4.25% on contracting activities while maintaining 2.25% on most other categories. This approach captures revenue from new construction while remaining competitive on retail. However, Kauppi noted a legal trade-off: higher construction TPT rates must be offset against allowable impact fees.

Councilmember Rupert Wolfert emphasized the need to identify existing businesses within town limits. This data will help the council understand which industries could provide the strongest tax base.

“Once we play around with those numbers, we can get a better idea of what kinds of businesses we wanna start attracting,” Wolfert said.

Food Tax Likely Unavailable for San Tan Valley

Grocery purchases represent a significant potential revenue source. At the January 7 council meeting, Walker noted that towns could have a grocery tax within the retail category. However, recent state legislation may prevent San Tan Valley from implementing one.

During his town manager report, Billingsley identified food taxes as “a very important topic, especially to our sister cities.” He cited two bills in the current legislative session: HCR 2018, which has been pushed to the ballot, and House Bill 2839. “We’re still early in the session. We don’t know where it’s gonna go,” Billingsley said.

Councilmember Gia Jenkins noted there are additional TPT-related bills in the legislature, including one affecting utilities. The council agreed to proceed with the existing laws and adjust if necessary.

“Last year’s bill significantly impaired our ability to do a food tax,” Town Attorney Allen Quist explained. “They didn’t make a carve out for newly incorporated towns and cities. The legislature thought that the probability of that happening was so minimal, they didn’t want to create extra language around it.”

Most Pinal County cities with food taxes were grandfathered under previous law. They typically charge 2% on food for home consumption. Under current law, San Tan Valley likely cannot access this provision unless the legislature changes it.

Billingsley confirmed the situation remains uncertain. “The way the bill was written last year, unless things change, we actually can’t have a food tax,” he said. Additional bills affecting TPT have been introduced this legislative session.

Wolfert acknowledged this limitation affects the town’s strategy. “We gotta be more creative now that food taxes are off the table,” he said.

Maricopa’s Experience Offers Lessons

Billingsley shared his experience with the City of Maricopa’s incorporation. That city strategically used both impact fees and TPT on construction activities to fund major infrastructure.

“When Maricopa was a brand new city, it was very much cognizant of the importance of development paying its own way,” Billingsley said. “It was an early adopter of development impact fees, but also transaction privilege tax with respect to construction activities. They would not have a police station, a city hall, any of that infrastructure now if they did not adopt that TPT rate specifically on the construction items.”

Maricopa used one-time construction TPT revenue to purchase land for Copper Sky Park and the City Hall complex. Those funds also built the city hall, council chambers, and the first police station.

Who Will Provide TPT Recommendations

The Arizona League of Cities and Towns will guide San Tan Valley through implementation. Lee Grafstrom, the League’s Tax Policy Analyst, presented the Model City Tax Code framework to the council on November 5, 2025.

“Lee is at the forefront of all of these legislative discussions,” Kauppi said. “He goes before the legislators talking about TPT rates. He’s giving that same presentation to them as you’ve received it too.”

At the municipal level, Kauppi and consultant Pat Walker will continue assisting staff. The town may need to pay the state or other entities to research which businesses operate within town boundaries and their tax classifications.

“We don’t think any of that information exists where we could just go to it,” Billingsley said. “We may have to pay somebody to pull some of that data.”

No Voter Approval Required for TPT

Councilmember Brian Tyler asked whether voters must approve any tax structure. Mayor Schnepf clarified the distinction.

“Not on TPT,” the Mayor said. Property tax implementation requires voter approval. Transaction privilege taxes do not.

At the January 7 council meeting, Walker explained that establishing a primary property tax requires a public election on the third Tuesday in May. She said towns typically give 150 days of public notice before such elections.

Mayor Schnepf directed staff to proceed with TPT research, with council members expressing support. Billingsley emphasized that time is limited if the council wants to meet certain deadlines.

Implementation Timeline and Deadlines

Kauppi explained that TPT implementation requires approximately four months. New rates must begin on the first day of a calendar quarter. Kauppi cited July 1 and October 1 as examples.

Kauppi said the League prefers July 1 or January 1 because many businesses file taxes on a calendar year basis. Mid-quarter or mid-year implementation creates complications for businesses.

If the council wants a July 1 implementation date, decisions must begin immediately.

Mayor Affirms Local Revenue Benefits

Mayor Schnepf expressed support for moving forward with TPT research. He acknowledged the impact on other municipalities while defending San Tan Valley’s position.

“It’s about time that the citizens of San Tan Valley get to see those tax dollars coming back to this area,” Schnepf said. “We’ve also helped fund those cities and towns for quite a long time. But it’s time for us to do what we need to do for our area.”

The council also expressed concern for residents. Wolfert noted that any tax burden ultimately affects local households.

“Everyone’s talking about affordable. We wanna be mindful of our residents,” Wolfert said. “We gotta be balanced. We gotta be realistic.”

Council Direction: Research Continues

Staff will now gather data on existing businesses, taxable sales estimates, and rate structure options. The council expects this information before making final decisions on specific rates.